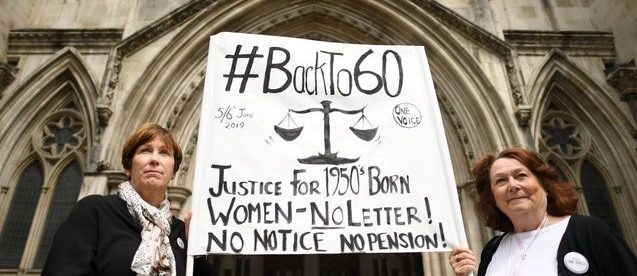

1950s women cheated of their pensions – BackTo60 outcome

Women born in the 1950s have been fighting to have a decision on their pension ages overturned. Today, senior justices ruled that the BackTo60 campaign has been unsuccessful.

Having paid into a system in good faith for years, as the end was in sight, the finishing post has been moved, with many women losing up to seven years of pension.

For many women – and families – this has been catastrophic. They’ve planned and budgeted for their retirement in good faith, trusting the country and economy they’ve contributed towards to support them when they need it most, and for some of them the loss of those years of pension payments equates to tens of thousands of pounds lost. It’s brought hardship, poverty and misery to millions.

…this would only be appropriate if things were ACTUALLY equal. If the pensionable age is going to be the same, let’s see an end to gender pay gaps. Let’s remove those glass ceilings

The reasoning behind the move (apart from the obvious ‘ker-ching’) is threaded around the need for equality – to bring women’s retirement into line with men’s. And of course I’m all for equality. But this would only be appropriate if things were ACTUALLY equal. If the pensionable age is going to be the same, let’s see an end to gender pay gaps. Let’s remove those glass ceilings. Let’s give women the same privileges and entitlements that men enjoy.

It’s tough for women!

As a woman in business I’ve had to fight tooth and nail for what I have. I’ve brought my daughter up as a single parent with next to no financial support from her father, who’s been happy to see Tax Credits and Child Benefit do his bit. I’ve built up three successful businesses and it’s been SO MUCH harder because I’m a woman.

I’ve not been part of the ‘boys’ club’ although I have to say, things are changing, finally. I even got invited to be part of a charity golf tournament the other day! But I’ve lost count of the times I’ve made meetings happen, for example, simply because my target thought I was a male Sam. Always enjoyed their faces when I’ve turned up.

But I digress, if only to express my solidarity. You want equality? Then do it properly. I’m 49 and hadn’t really thought much about my pension or retirement until recently, but I am at least prepared now for the extra slog. For many of the women a bit older than me though, it’s been devastating, and I feel righteously furious on their behalf. Their voices need to be heard. Here are some of their stories.

At the foot of this piece is more information about the judicial hearing and campaigning.

Jackie Lee

Can I tell you my story? I was born in 1957 – we are called ‘Baby Boomers’ which is an insult to our parents I think. We do not decide when we are born but 1950s women have worked all their lives for the UK to thrive.

I was born into a family of six children and being the eldest was a second ‘mum’ to all my siblings. I had a happy childhood, even though I had to take care of my brothers and sister, and had a Saturday job from 13 years old, as well as going to school.

When I left school on the Friday in July 1972 I started work the following Monday. I earned very little and had to pass the majority of it over to help the family. I would have loved to have gone to university, or even sixth form, but I was never allowed.

Even when they were small I found work in supermarkets, cleaning wherever was needed, any job I could do even if it was menial; I even worked when my husband had finished his work for the day

I left home and got married in October 1976 – I signed the NI1/CF9 form, which was the form to sign if you were paying full National Insurance contributions and wanted a pension in your own right at 60. I carried on with my life working, looking after my home and husband, bringing up and nurturing three children.

Even when they were small I found work in supermarkets, cleaning wherever was needed, any job I could do even if it was menial; I even worked when my husband had finished his work for the day. So not only was I looking after young children, keeping my house in order and making sure my husband had a good meal when he came home, I then went out to work after doing all that.

It was what we did, so I did it. When my children started full time education I could work for slightly longer, although at that time we did not have maternity leave and free nursery places.

I gradually increased my working time as my children grew and then was back working full time. Always paying my full NI contributions. I had a life, but always in my mind I was retiring at 60. In 2015 I was made redundant, but I had no worries as myself and my husband had a little savings and he was still working, so we could afford it with no problem. I then sent off for my State Pension forecast from DWP.

You could have knocked me over with a feather when the forecast was that instead of me retiring in 2017 – I was now retiring in 2023. I could not believe that I now have a retirement age of 66, after all those years of doing ‘what is right’, not being a burden on the state, paying for everything myself and working my whole life.

I am now 61 going on 62. I have not been able to find another job, even though I have sent many applications off, even for Apprenticeships. Our MP from the Department of Work and Pensions Guy Opperman stated that we of the age over 60 should apply: I have and I can imagine what the conversation is when they are read by the company who want a young 16/17/18 year old to train, and not a 60+ woman.

State Pension is not a benefit; we have paid into it all our working life and we would like some justice

So now I have no income and my husband is obliged to look after me (as per DWP). We hardly see each other as he has to take on more work to earn more for us to live a day at a time. Our savings have gone, our bills are going ever higher and we do not have any spare money for any of the things we had planned to do in our retirement. My husband will have to stay at work for an extra three years to be able for us to live. Our government calls this equality!

We are pensioners living hand to mouth – we are living in poverty and our human rights have most definitely been abused. State Pension is not a benefit; we have paid into it all our working life and we would like some justice regarding the £45K each and every one of the 3.8 million 60+ year olds will have lost.

Paula Howard

The biggest pension swindle of all is being carried out by the British government. I paid into my pension for 44 years and when I claimed age 60 they said that they had changed the payment date and I would not get it until I am 66. I had never been informed of this change and they have since said they put an advert in the Times, a paper I have never read. They did not deem it necessary to inform me or any of the other ladies affected.

Pat MacDonald

Us 50s women have been robbed. I have lost £42,000. I have had to downsize my family home regrettably. Suffered depression after this. Now three years later I’m starting to enjoy my home. I will have to wait till March 2020 to get my pension. I have paid 42 years National Insurance, yet won’t get full pension, as I once receive a small pension that I thought was a perk of the job. How silly of me. This was never explained.

Hilary Johnson

…we are on a very strict budget just so we can eat well in the winter and keep warm. Had to cut down on lots of things. We miss our cheese selections and meals out

I’m 61 and I’m not working at present because I’m looking after my disabled husband. I’ve worked ever since I left school. Had a hard time at work, the usual aches and pains. Went off work sick and then resigned due to the way I was treated – younger staff preferred. My hubby gets £3.74 a week for me. I no longer shop at Marks and Spencer’s or use my local shops, as we are on a very strict budget just so we can eat well in the winter and keep warm. Had to cut down on lots of things. We miss our cheese selections and meals out. If I had my pension that money would be put back into local businesses. We would be able to enjoy the simplest of things again.

Carol McGill

I believe myself and many other women have been scammed out of our state pensions. I started full-time work in 1972 at the age of just 15. In a low paid and menial job without the qualifications to do any better I paid into the NI with the understanding that I would get my state pension at 60. I now gave to work until I’m 66. I’m lucky in that I’ve managed to get work with the NHS, but only on a contract, and still low pay. I’ve had a terrible education and spent much of my life educating myself and have ended up with an MA. I’m bitter and angry about the betrayal of my country towards us women, some of whom are really struggling financially.

Tina Reed

Please support the women who have been duped and expected their pension at 60!! I was born in July 1955, I have worked all my life even between treatments for cancer to make sure mortgage was paid. I had to leave work due to further poor health recently and now we have to sell our home to survive. There is no justice… I feel well and truly ‘ripped off’. There are many others in dire straits due to having no notice given to us; stressed, anxious and with nothing left. It was not just 18 months added to our age, in most cases it was six years, and mine is such a case.

Carol Hayes

I am a 1950s born woman who will not receive her pension until 2021. I started full time work at 16 and paid National Insurance with the knowledge I would retire at 60. I have worked most of my life apart from when my children were small as I took a little time to care for them and went back to work as soon as I could.

My husband is unskilled, however he could earn more than I could so I only worked low pay part time to look after the children. We struggled all our lives, bought our own house with interest rates at 16% and an endowment which spectacularly failed.

It mostly affects low paid women working part time. We made sacrifices as a family to do the right thing and now I have to work an extra six years

Both of our children went to university and we supported them the best that we could. When my son was old enough I increased my hours to full time and joined the pension scheme. Unfortunately as this is NHS I was contracted out which means I get a lower pension eventually. This was never explained to me. Apparently the loss was supposed to be made up by our work pension but recent investigations show us to be worse off. Due to fybromyalgia and arthritis I had to reduce my hours in work and I now work four days, so less workplace pension too.

Women have been unfairly treated all our lives; only those with a high level of education and good jobs don’t feel the effect of these pension changes. It mostly affects low paid women working part time. We made sacrifices as a family to do the right thing and now I have to work an extra six years to get my pension, and no matter how hard or long I work I will never be able to replace the £48,000 I have had taken away by these changes.

We are now selling our house and are going to live with our daughter to fund our retirement as I will be leaving work at 64 years of age. I am so tired and worn out. I am lucky to have this option; some don’t and have been left destitute. This is a national scandal and government ignore it as it was never about equality, it was about money.

CAN THIS BE CHANGED?

There are a number of fierce campaigns to fight this change, including the notable WASPI women (Women Against State Pension Inequality), and the BackTo60 movement, backed by Michael Mansfield QC. But it’s more complicated than it at first looks, and most of the coverage you read will delve into the details surrounding the implementation of the age rise and how it was effected unfairly.

But its roots go far further back. In 1986, it was Margaret Thatcher’s government that ended the Treasury contribution to the National Insurance Fund that has now deprived 3.9 million women born in the 1950s of their pensions for up to six years. Ironically she could now be their saviour.

She ratified the United Nations Convention on the Elimination of All Forms of Discrimination 1979 (CEDAW) and it’s this decision that commits the United Kingdom to outlawing not only any discrimination against women who are unfairly treated, but demands reparations for the people who lost those rights. And it also provides a mechanism to deliver the money to 50s women without facing a legal challenge from any other group – whether it be the pensions industry or anyone else.

So although there will be challenges and questions to face surrounding the appalling mishandling of information and notice, the #BackTo60 group are going in hard with the CEDAW angle. And whilst there is a great deal to understand about CEDAW and the implications, in a nutshell, with the backing of politicians, something called a ‘Temporary Special Measure’ could be effected, based on a claim of inequality, that could work positively in the women’s favour.

The campaigns argue that the notice given to women born in the 1950s and early 60s was implemented unfairly, with little or no warning. And that the changes have been implemented too quickly, leaving women and families with no time to prepare, leading to shattering consequences. This discrimination could give them the leverage they need.

UPDATE SEPTEMBER 2020

Following the original publication of this article in June 2019.

The judicial review was held in June 2019, and in October 2019 the High Court rejected the claim that the legislation breached the European Convention on Human Rights, amongst other issues, including that there was no direct discrimination on grounds of sex, another argument brought by the campaign.

BackTo60 Ruling September 2020

The Backto60 campaign raised money publicly to bring an appeal and this was heard in July 2020. The appeal judgment, published on 15 September 2020, by Master of the Rolls Sir Terence Etherton, Lord Justice Underhill, and Lady Justice Rose unanimously dismissed the claim.

It was ruled that introducing the same state pension age for men and women did not amount to unlawful discrimination under EU or any human rights laws.

The justices said, “Despite the sympathy that we, like the members of the Divisional Court (High Court), feel for the appellants and other women in their position, we are satisfied that this is not a case where the court can interfere with the decisions taken through the Parliamentary process.”

The WASPI campaign is separate to this, and has approached the case in a different way.

For more information about WASPI click here

For more information about BackTo60 click here

Sam is Silver’s founder and editor-in-chief. She’s largely responsible for organising all the things, but still finds time to do the odd bit of writing. Not enough though. Send help.

To find a local WASPI Campaign group to join in Scotland and news of upcoming events and Holyrood debates please click here. wwww.waspiscotland.uk

Interesting article. Jackie Lee states she signed the DWP NI1/CF9 form to pay her NI contributions with a retirement age of 60. That is very well remembered! That probably means we all signed it too, if so, this could mean the DWP are in breach of contract and that all those paying NI contributions before the changes, should be paid their state pension at 60. This must be worth looking into.

It wasn’t a contract for state pension at a particular age. It was simply an election to either pay reduced rate NICs or full rate NICs. As you didn’t even get that choice if you married from April 1978 onwards very few will even have had a choice.

This is a marvellous campaign

I received a letter from DWP advising me of the changes in 2013, just 4 years before I was expecting my pension. Totally insufficient,imagine if they told men of 62 now they would need to wait until 72 to get their SP!

I am a woman who has missed out on 6yrs of pension due to being born in 1956. My friend who is 5.5yrs older than me has already been collecting her pension along with free bus pass and other benefits for 10yrs how is this fair?

This is a pertinent point you raise Sue in this argument. That being the discrimination against those born a few years prior to the reform changes, who received their State Pension at 69 or shortly thereafter, in contrast to those who were born after, having to wait up until 2021 for their pension. This means that within a 7 year period of time, those born on the rightvsude of the 59s have benefitted to the detriment of those born later from 1955. This is a case of pure discrimination.

The government has failed in trying to rush the changes through , affecting a group of women born within a short period of time. These changes should have been implemented gradually over a 25 year period to ease the financial burden of women who thought they would be able to retire at 60

Same as me I was born 1956 April 30th I am single never been married

Firstly I received no notification regarding not being allowed to retire at age 60,if I had been born 2 days before my birthday I would have retired at 60. I was born on the 8th April 1953.and because of the the change that came in my cut off date was the 6th April 1953 meaning for two days I had to work an extra 3,1/2 years before i could retire,and once I retired a did not receive a full pension because I was short off stamps for some of the years I brought up my children and now I receive the lower pension amount.if I had known all this regarding changes I could have been more prepared and paid for extra stamps,but have lost over £25,000 thousand pounds because D Cameron via the Tories robbed the pensioners out off their pension,and the gauling thing about it was I worked in the NHS for years and when I notified them I would be retiring that year they informed me I could not as the government had changed my retiring date for another 3 ,1/2 years I was devastated to learn this,If i had been born 2 days before my birthday i could have retired at age 60.an absolute discrace,and my husband has had to work untill 66 losing a years pension.

Hi my Roger i agree the government shouldn’t raise the age for pension if we live longer all the better to enjoy i am supporting you all the way

There was no cut off date of 6th April 1953. If you had been born on the 6th April your SPA would be exactly the same as it was for someone born the 8th April 53. Even if you had been born on the 5th April 53 you still would not have received your pension at age 60. Instead you would have got it only 4 months earlier at age 62yrs 11 mths instead of 63 yrs 3 mths.

After the 1995 Act your state pension date moved to May 2016. The 2011 Act only added another 2 months unlike many of us that got an extra 18 months added on at short notice.

I can relate to you, i was born Jan 1954. I worked for NHS from when i left school until i had my children. When my children were small i did knitting fir designers to earn extra money and then when my children went to school i found a job in Soecial Needs Education of which i worked fir 26 years. During this time my father died and my mother went blind but i looked after her needs and never asjed for help. I was not notified about the mive if goalpost for State Pension. At the age 56 i had to have a hip replacement so thought i could manage 4 years until i retired but littke did i know i wouldnt get my state pension. So the lump sum i took from my works pension instead of being my nest egg had to be spent to cover my shortfall for 5years 5months. A lot of money is being paid out left right and centre by the government but us women who worked saved and didnt milk the benefits are the ones to suffer.

I am 61 years old & as soon as I found out about the age increase in downsized my house moving away from family & friends in order to have some savings to live off , so in my eyes I have done the right thing & made allowances. ..so why am I now penalised for having savings because my partner was made redundant having worked all his life & because of me cannot receive a penny in unemployment benefits, so I am keeping the two of us on very little indeed …yet I followed dwp advice & scrimped & saved for years , it feels like I’m just wishing my life away watching every penny , my partner & I have 43 years of contributions each

NB error. Meant to say 60 and 50s

I am being discriminated against !

This change was supposed to be about bringing Pensions equal with Men & Women which is not so.It was an excuse to take earned pensions awayfrom Women.

Women born in 1952 have been placed on the Lower Rate and Men of exactly the same age have been placed on the Higher Rate approx £40 a week more for life plus future percentage increases

I was born in 1950,my sister in 1948,she got her pension at 60 ,I had to wait till I was 62 and a half ,I thought it was really unfair as I always thought I could retire at 60.

I was born December 1952 retired at 62.9 months in September 2015 just before cut off date for the New State Pension started on 6th April 2016 at £175 a week thats if your retirement date fell after April 2016 , which means I am on the old Pension Rate £135 a week …So how is it that a Man born the same time as me in 1952 is on the New higher Pension £175 a week for the rest of his life and no plans by the Government to gradually close the pay gap . I feel cheated not just once but twice!That’s not Equality ! Its sex discrimination !!!

I am in the same situation as yourself Anne, born in November 1955

It has been so detrimental to the lives and wellbeing of so many. When we became adult women in the 79’s life and roles fir women were very different . My mother had never worked and so entering work after Uni was a first fir women in my family . I took time out bringing up a baby as that was normal then – though worked part time. There was no childcare , no vouchers and so work had to fit round the family – and it’s what everyone round me was doing. I have still managed to work 40 full years- I also put my wages into a private pension fir my husband and following divorce get none if that . I’m just about to be made redundant at 60 and have no use how I will survive until the 66 I never ever planned for. I’m not being greedy or lazy – I’m exhausted and worried .

So what was the result on the 5/6th June with the judicial review. Are we fighting a losing battle here?

I received a DWP letter advising I would get my pension at 61.5 years. Heard nothing since. Now 65.5 years and just started to receive it. After paying on for nearly 48 years when applying advised ‘ we’ll see if you’ryou’re entitled’

I am 63 so I was a 50s baby and I am having to still work which I have done all my working life .I had six children while they where growing up my husband would come home from work and I would go out to work nights I have a few health issues but I still work and feel that if i had my pension I would not have to do so much

Women have not “lost”any money. All this means is that they have to work longer before being eligible for a state pension, just like men have always done

Oh Ken come on, did you keep house, cook, clean, washing, raise a family and hold down a job to make ends meet. Most of these women did so i believe we earned our pension more than some men.

I am 64. I retired in 2012, due to ill health. I wasn’t given a choice.I get a very small occupational pension. We had a struggle to get by as my husband has had severe health problems. He got his SP in July, 5 months after his 65th birthday. (What’s that about if it’s not stealing money?) When savings ran out we had to claim benefits, which is a nightmare story on its own.My husband has been in very poor health for a long time. Then I became ill with not 1 serious health problems but 2. We thought we would be ok when he started to receive his State Pension. We were counting the days. Wrong! The upshot of it is that until I draw my State Pension in 2020 we will be living off his State Pension. Both of us. No help from anyone else. Our Macmillan welfare rights officer said we are now a mixed couple.I know it’s designed to make me find work. It’s an impossibility. If it wasn’t for the fact that it is only 16 months to go to my pension, I think we both felt like turning our toes up. And hey, presto, when I am pensionable age get some benefits re-instated. I thought I would be living with such hardship. Can anyone tell me the reason for this, if it’s not that the government are bleeding us dry? If you are just reaching 60 I feel sorry for you, especially as the pension age is set to rise again. If you are in your low fifties put together as much as you can comfortably afford and don’t touch it till you are 60. Even if it’s only a small amount. You will need it. Can I just make the point that if couples reach 60 at around the same time you won’t get these problems. It’s mixed age couples going on to Universal credit need to prepare. Get welfare advice. Sorry to drag on.

Thanks Polly – some helpful advice there too.

I have been hit twice!! My pension was moved from 60 to 65 and the nearer I get to 65 they moved it again to 66!!this is doubly unfair!!! And again with hardly any warning!!

I was bor 1957 started work at 15 years 3 month worked all my life brought 2 kids up expected to retire at 60 only to find extra 6 years been added

They did the same to me, born November 1955. But there is also a double- double whammy. I paid into the 2nd State Pension, however after the pension reforms when the 2nd pension was supposedly integrated into the pension in general, these people have lost out yet again. Paramount to ‚legal‘ theft.

This is so unfair, the young don’t realise that a lot of women back then was working from the age of 15 and paying their NI through their wages. Basically the government want to take of the older generation to give to younger generation who c as nt be bothered to work and save. I’m 42 so I have all this to come

I think it is totally unfair on women born in the 50s the government have robbed them it’s disgusting and the pension they deserve is been given to lazy gets who’ve done nothing but the old ones are paying the price equality my arse yes the age is equal but not the financial aspects these women have lost thousands and this government need to address this matter I too have worked all my life never claiming a penny get real mps n do the right thing or you’ll not get in again you’ve been lent my vote and many others so let’s get this pension fiasco done!!!!!!!

It has been so unfair to all the women of my generation that should have got their pension at 60.

We are all struggling now, used our savings.

Government should step in because l was so looking forward to my pension and now have to wait til I’m 66.

Lot of my friends have worked all their life and has passed away not even getting their pension.

So very unfair indeed.

Entirely agree we have been scammed by the government got my pension at 64 and 3 months put back twice absolutely disgraceful

I was born in 1952. My pension was put back to 62.5 years. People may say that’s not too bad, but I am on the old pension rate which is much lower than the new rate. If I live to say 80 yrs. I will lose many thousands of pounds. So I have had a double whammy.

Hello Julia..I am the same born in December 1952 retired September 2015 missed the New State higher Pension that started in April 6th 2016 and put on the lower pension rate having full contributions .But did you know Men born in 1952 are on the higher New Pension rate ? This is discrimination and inequality towards Women

Please read the table below by the Express very carefully .The wording in itself in my opinion is to avoid drawing attention to Women like us :

EXPRESS FINANCE

What is State Pension?

• You can claim the basic State

Pension if you’re:

– A man born before April 6, 1951

– A woman born before April 6, 1953

• If you were born later, you’ll need to claim the new State Pension.

• The most you can get on the basic State Pension is £134.25 per week.

• The full new State Pension is £175.20 per week.

Notice that Men and Women born in 1952 are on different Pension rates

How come the government could find the money to bail out the BANKS – Banks that robbed ordinary people with PPI and the likes but they won’t consider helping the people born in the 1950s (which I am one of) I am single with no savings no family and have to work until I am 66.5 thinking I would retire at 60 and have a bit if me time.

It’s an absolute disgrace.

Why dont the government come up with a scheme let someone in there ,60s be replaced by someone on benefits because I’m 65 still working 20 hrs and people on PIP an other benefits getting more than me how is that making work pay ?

This is the biggest scandal out the stealing of our pensions for women born in the 1950s who have paid in all their working lives working in menial jobs etc. The government need to sort this out we (I’m 62) that

Have been medically retired from work because of illnesses etc have been left with absolutely nothing how long will it be before some of us commit suicide we are hardly living anyway just surviving day to day .

With the Back to 60 appeal In the High Court on 21/2 July – one view on how this fight has united women:

Give and Take

Taken from us – freedom of choice

Expectation and long-awaited reward

Our hopes, our plans, our voice

Our protestations ignored

Undeserved and unjust

A ruling without care

Years believing we could trust

But we were unaware

Taken from us – our liberty, our time

Moments to treasure

Future undefined

What joy, what pleasure?

The here and now tainted

The burden too heavy

Our canvas repainted

To account for this levy

Taken from us – healthy body and mind

Positivity and strength

Impossible to find

A gut twisting wrench

Yet amidst the betrayal and dismay

A small and surprising chink of light

Friendships made along the way

United – fighting the fight!

Given to us – new connections near and far

Understanding and care

A text or call to see how we are

Knowing there’s someone else there

Women supporting Women

Against government and press

Fighting together

Doing what Women do best.

Dena Hunt July 2020

I am 65 and will not receive my state pension until next May.

I have worked all my life and this decision is just so unfair as no notice was given to me about this!

I have voted all my life but from now on I will not as ministers in the government only care about themselves!

The fact that the money that was in the pension fund has been used elsewhere to bail the government out of other errors they’ve made is scandalous. If this was a company pension fund & the money had been misappropriated in the same way there would be hell to pay. This is still thievery of people’s money. I have paid my dues since I was 15,49 years of contributions. It’s time for this wrong to finally be righted.

Equality great but don’t inflict it on the 1950s women who had no equality through their lives.As a women I couldn’t do Science except for the first year and had subjects like Mothercraft, Housecraft and Typing. It was obvious that in the few years before my real Career I was to be a Typist which I fulfilled. There were no O levels at my girls school, why would women need them and we wouldn’t be going on to further education anyway.

At Work I didn’t get equal pay as a woman, and even had to pay higher National Insurance to retire at 60! I paid into Graduated Pension for some years as this meant an extra State Pension amount when I retired at 60. This earned payout was cancelled in 2016 and All my extra National Insurance was kept! This year I should have had an extra State Pension amount of about £30 per week for life but it was stolen by introducing a new law!

Started a family, only a few weeks Maternity leave and money. No Nurseries and anyway women who somehow dared to work and have their own money werent virtually shunned. I had just been accepted to do Nursing but obviously that Career was impossible now. I worked in the Home selling knitted goods and later took care of other children in my Home so I could have my own money instead of the few pound my Husband thought I needed.

My youngest (of 3) children was 7 and took on part time Cleaning, Caring for the Elderly work so I could still take my youngest back and forth to School and fulfil all my Household jobs. I didn’t have a car so travelled either on foot or by bike to people’s homes. My Husband (now ex) worked from Home at one time but I still received no lift despite snow and rain at times. I came home from work and cleaned round my Husbands feet while he watched tv! At work was on low wages and for years couldn’t get a Works Pension.

When my Children were grown up I became Divorced and carried on working. I then took on taking care of my Mother which meant living there and only getting a few hours sleep a night. My Job made me Disabled, I started breaking bones so had to give up working. I couldn’t get Any Benefit as I had my Divorced money so I lived off that (my Retirement money?). Finally I was almost spent up so claimed ESA at 60 instead of Retiring (received my

letter at 58). I was taken to Court as my Medical was totally incorrect and had a breakdown. Couldn’t attend but had the decision by the ESA overturned. They also messed up my payment around that time and left me on £9.99 a week for 8 months! Received food parcel and obviously got into debt. Not how I imagined my 60s. I was born in 1954 and my gradual increase in years went from 60 to 66!! All my Retirement Savings gone now and when I reach 66 I am selling my Home. Trying to do some private work Cleaning and Caring (couldn’t get work because Disabled) has resulted in 2 operations as I broke 3 more bones.

Our Generation was the one, who on the whole took part time menial work to fit in with Caring for the whole family (Grandchildren too). Did manual work that is impossible past 60. Why have our Generation who wherent treated equally at School and Work suddenly given 6 years extra to wait for our Pensions. 1950s ladies received little Equality, the full 6 years should have been given to those women who had Careers and could work Not us. Equality now after so much Inequality!!

I too am a 1956 baby. Worked since I was 15 bringing up 3 children on the way. I did not have notice until it was far too late to do anything about it, we had worked out our mortgage and economy around our pensions. I am all for equality but we were not told early enough and it was carried out rather quickly so we were unable to make economic changes to our household.

No woman ever paid higher NI than a man. You are getting mixed up with the cost to buy a unit of Graduated Retirement Benefit which was higher at £9 against £7.50 for a man. In 1995 they also equalised the cost of the units for anyone retiring from April 2010 onwards. They made it £7.50 for both.

45 years of working & paying full NI & Tax & already 6 years of caring for elderly sick parents.Living on £67.25 Carers Allowance a week.

Fingers crossed for the review on 21/7/20 to change the law for Waspi & Back to 60 group & all women 60+ in the UK. DWP & The Government need do the right thing now as immigrants arriving on the south coast seem to be more important to support than us.

Please withhold personal details

Disgraceful the government has stolen people’s money they have earned over the years. It’s a different world in London they haven’t a clue or if they have shame on them.

I was born in 1954,have paid 50 years full NI. I am due my pension now a month before my 66th birthday. I’m fortunate I suppose I’ve had a full time job but have paid the price with my health.

Being born in the 50 I expected to retire at sixty I have been robbed of that not once but twice 65 was bad enough but now its 66 having a father with a terminal illness I thought I would have more time to look after him I also have my own health issues but still have to work full time I feel very much let down by the government.

I started work just before my 15th birthday, i have 47 years of contributions, two years ago i had to stop work as i have arthritis in my hands, feet, hips, and back, i claimed ESA, now this week i get my first pension payment and i have lost £22 a week, thats almost £100 a month, cant claim pension credits because the pension is£2 over. I despair, we were not allowed to take exams and go to college or University because we didnt need to, we would leave to have children, my brothers went but me and my sisters didnt, i have no private pension and no husband. Myself and my 3 sisters plus a sister in law are all 50’s woman, and have 200 years of contributions between us, thats from just one family and we have all lost out, me in particular as i am the 1954 one. I am struggling now !!

I have paid the maximum in and have to wait an extra 6 years for my pension. I have worked in care all my life for poor wages. I could not afford a private pension. Unfortunately I now need someone to help me due to poor health. It’s not fair on any level. I have to say if this were happening to men there would be anarchy. Just another indication of not being valued.

Born in 1956 it was an expectation woman would retire at 60. As a woman you are treated as a second class citizen – no equality at school or work, even less in the wages dept. I’m now living of my retirement savings as at 64 nobody will employ me. I was a policewoman for 6 years and worked for the NHS for 11 years. I was TUPEd over so my penslon there is subsequently less. I’m now divorced so no husbands pension either. When my children were small I had at one time 3 jobs as well as all the domestic responsibilities – no nurseries or nannysitters in my day. I’ve worked since I was 16 so I’m due. I’ve lost almost £40,000 where is it ?

Well done WASPS women I born in 1954 and l loss a lot of money had no warning, but how come the Tory got in again when there no free TV license, still trying to make the state pension older for men and women.

Entirely agree we have been scammed by the government got my pension at 64 and 3 months put back twice absolutely disgraceful

Born 1956 .I was 58 when I found out I could not get my pension at 60 .it came at the worst time for me as my partner died of cancer .so as a single person I was looking forward to getting my pension and still work .as that as not happened I am living on a low wage struggling to get by also the bus pass was taken and help with gas and electric all of these you got when you turned 60 now it’s 66 . I was 14 when I started work lived with my partner from 1976- 2012 .brought up 3 children and never once did we claim anything .we both worked hard.i was 56 when my partner died and aged 58 when I was told I had to work a extra 6 years .I needed my pension at 60 as well as the bus pass and my wages to get by .this injustice on 1950 women is a scandal I hope we back to 60 win at the court of appeal .up to now at age 64 I have worked 50 years .they owe me big time

Hi Jenny

It appears to me from your comment and others, that each individual has a different case with re

Spent to pensions and employment histories. The government has not taken these into account, but devised instead a ‚blanket‘ algorithm, one size fits all. They need to be made aware of these and assess each individual case on its individual merits.

I was born in 54. In 2014 my daughter was diagnosed with breast cancer. She had a husband and 1year old. I had a mortgage. I was expecting to get my pension in 2014. I could have worked part time and spent time with my daughter who died in 2017. Only got my pension in 2020. Been robbed more than financupially

1956, always worked. Babysat whilst at school, supermarket work in holidays, 41 years as a manager (Not well paid) and now having to work again to make up the 6 years. Now reliant on my partner who cannot give up his job despite dangerous ill health, diabetes and liver disease. He’s had 1 year added too. It was all about saving £50 Billion, not equality. We would have both been able to work part time IF we had had my pension at 60. All gone. Why on earth do they target the hard working?

I too have been robbed of 6 years pension, left school age 15 to care for my mother who had terminal cancer started work one week after she passed away shop work so not a great wage, worked full time for 30 years married and divorced in that period gave up work after having a longed for child with my current partner then took on part-time work to work around my partner.. He walked in the door I walked out when my child started school took on another part time job to make ends meet at one point had 3 part time jobs always working around school or in the evening when my partner was home what you don’t realise is that when you work part-time you pay little or no NI contributions unlike tax where they lump all your earnings together so at 60 I was hoping to retire but no such luck now I find out that I won’t get the full state pension either due to missed contributions and being contracted out all my savings gone not the retirement I dreamed of or deserve after working hard all my life and never claimed anything feel very let down by the government

I think it’s criminal robbing us of our pension.. I was not informed of the retirement age rising i read about it in the paper.. I was born Aug 59 worked since age 17,had time off to have a baby,soon after went back to work with my boy in tow.. Now i have to find employment to live, much chance of that,i live in a small town with few employers,don’t drive,very little bus service.. I’ve never believed anything the government says and now my belief in not voting for any of them is vindicated..All out to line they’re own pockets like the scandal of buying wide screen tv’s for themselves and places to live… Who paid for that?.. When women die,as my mother did before collecting her pension,which she’d earned who got that..Certainly not the family..

I was born 1055 worked all my life paid full contributions as was advised I was not informed of changes to pension and as I am divorced I am struggling through no fault of my own .

I work 16 hrs then this is topped up by universal credit I have never been on benefits in my life before this is what I’m reduced to

The government doesn’t care they pay for stupid things for MPs for there 2nd homes fridges microwaves even pay them to attend the house of commons this should all be stopped every government is ripping off the working class who all work hard to keep this country going please stand up this can’t keep happening enough is enough.

The government dosnt care about fifties born women. The government are no more than thieves . Not only being made to work 6 extra years no bus no cold weather payment . We cannot claim any benefits it it was all equal in this supposedly United Kingdom how come ppl in Scotland and Wales retire at 60 also receive a bus pass . The only thing we get is free prescriptions I believe this only because it cost millions to reprint prescription pads. Now we are expendable one moment over 60 is vulnerable should shield few hours later we should take care and go to work. The WHO state everyone over 60 is vulnerable to covid 19 but uk government say different WHO say the only reason must be one of economics no surprise there then ! Over 60 are then put into groups 6 and 7 despite many working in essential and frontline jobs coming into contact with hundreds of ppl. There can be no other group so penalised just for being born at the wrong time. I now do not trust anything the government say I have already cashed in one personal pension just to exist . I only got a small amount as the government kindly take 75% .if cashed in early! I feel tired exhausted drained I have worked since I was 15 only had 5 years with my daughter then I had to get a job as my ex husband lost his job . My husband was abusive mentally and physically I stayed till my daughter was grown up still working . I am still working . I am being bullied at work now off on sick leave due back soon. I have just over a year still till I collect my pension. To add insult to injury you don’t get the pension on your birthday as it is paid one month in arrears so I you actually work 66 years plus one month. I don’t think I will ever collect my pension as ii work in retail lots of ppl are dying from or are ill with covid . I fear I will either die from covid or take my own life as I can’t cope with this life any more it’s just too hard there’s no help for women born in the 1950’s everything has an end date ! When I hear ppl moaning that they haven’t had their second covid jab or about how long they wait in the queue they should be thankful they are not born in the 1950’s we are the forgotten ppl who no one cares about we are the expendable era!

The political parties were wrong to penalise women born in the 1950’s totally wrong it is infact disgusting this needs to be put right immediately pay the the state pension they are owed and deserve you the government have stolen this money

Yes, there are many of us in similar situations, burnt each with a different set off circumstances affecting our ability to lay our bills. Some of us even laid into the 2nd State Pension to enhance payments and these were just glibly taken away and invested into the basic state pension.

I will only receive £136 per week, which works out at less than £20 a day to live off. Works out at approx half the living minimum wage. What a rip off. We must continue to fight this injustice through groups like Waspinand Backto60.

On Job Seekers Allowance until 03.09.20 when I start my 26th job – not including working as a shampooer in a hairdressers from age 14. 45 years plus paying in to a system now telling me I need to carry on till I’ve paid in for 51 years. I can stop working at age 66.

I was born in March 1955 & left school at 15 without staying on to further my education as my father was out of work due to illness so I needed to contribute to the family income as early as I could. After getting married in 1972 & having 4 children to care for I could only fit in part time jobs here & there with no private pension options to cushion me later in life. My husband was self employed & worked away a lot of the time.

Now at age 65 I am waiting for my pension which I should get next year at age 66. My husband got his 2 years ago at age 65 but I have got to wait that extra year. That’s sexual discrimination in this household alone. How many more are there?

We have had to downsize in order to make ends meet. My husband at 67 is still working part time even though he has been diagnosed with a heart condition.

How can this be fair to the over 60s? Women are being cheated out of their pension years and in lots of cases the poor men are having to either get or hang on to a job of some kind to make up for the shortfall.

I can remember our previous generation being able to actually enjoy a bit of time to enjoy their retirement years without this having to keep a foot in the workplace unless they chose to.

The other thing is the free bus pass. Women are still entitled to get this at 60 in Wales, Scotland and Northern Ireland. Only England is different. Some English cities offer this but most don’t.

I don’t think many realise that as well as having to work an extra 6 years, 50s born women stand to lose £54,000 in pension funds they and their employers have paid into ! They will never see that money again!